Affordable Insurance for Small Consulting Firms sets the stage for this informative discussion, shedding light on the crucial aspects of insurance coverage tailored for small consulting firms. From exploring factors influencing insurance costs to essential coverage types and strategies for cost reduction, this topic delves into the intricacies of securing affordable insurance solutions for consulting businesses.

Factors influencing insurance costs for small consulting firms

Insurance costs for small consulting firms can vary based on several key factors that influence affordability and premiums.

Size of the consulting firm

The size of a consulting firm can significantly impact insurance affordability. Smaller firms with fewer employees and lower revenue may qualify for lower premiums compared to larger firms with more extensive operations.

Type of consulting services offered

The type of consulting services offered by a firm can also affect insurance premiums. For example, a firm providing risk management consulting may face higher premiums due to the nature of the services offered, compared to a firm offering marketing consulting services.

Risk factors

- Client base: The type of clients served by a consulting firm can impact insurance costs. Working with high-risk clients may lead to higher premiums.

- Claims history: A history of insurance claims can result in increased premiums for small consulting firms.

- Business location: The location of a consulting firm can influence insurance costs, with firms in high-risk areas facing higher premiums.

Location and regional factors

The location of a consulting firm plays a crucial role in determining insurance affordability. Factors such as local regulations, crime rates, and weather conditions can impact insurance costs for small consulting firms operating in different regions.

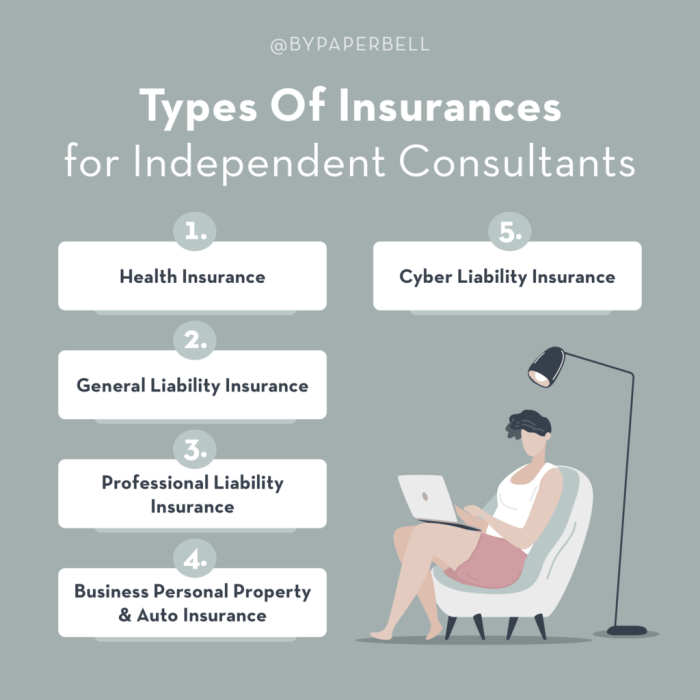

Types of insurance coverage essential for small consulting firms

Small consulting firms need to have various types of insurance coverage to protect their business from potential risks and liabilities. Here are the key insurance policies necessary for small consulting firms:

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is crucial for consulting businesses. This type of insurance provides coverage in case a client alleges that your advice or services caused them financial harm. It helps cover legal fees, settlement costs, and damages resulting from professional mistakes or negligence.

General Liability Insurance

General liability insurance is another essential coverage for small consulting firms. This policy protects your business from third-party claims of bodily injury, property damage, or advertising injury. It can help cover medical expenses, legal fees, and settlements in case a client or visitor is injured on your premises or if your business is accused of causing property damage.

Comprehensive Insurance Coverage Plan

For a comprehensive insurance coverage plan tailored for small consulting firms, it is recommended to combine professional liability insurance with general liability insurance. This dual coverage can provide a strong shield against various risks and liabilities that consulting businesses may face.

Additionally, depending on the nature of your consulting services, you may also consider other types of insurance such as cyber liability insurance, business property insurance, and workers' compensation insurance to ensure full protection for your firm.

Strategies to reduce insurance costs for small consulting firms

Reducing insurance costs is crucial for small consulting firms to maintain financial stability. By implementing effective risk management practices, bundling insurance policies, implementing safety measures, and negotiating with insurance providers, small consulting firms can significantly lower their insurance premiums.

Risk Management Practices

Implementing strong risk management practices can help small consulting firms reduce the likelihood of claims, ultimately leading to lower insurance premiums. By identifying potential risks, creating mitigation strategies, and maintaining a safe work environment, firms can demonstrate to insurance providers that they are proactive in minimizing risks.

Bundling Insurance Policies

Bundling insurance policies, such as combining general liability and professional liability coverage, can often result in cost savings for small consulting firms. Insurance providers may offer discounts for bundling policies, making it a cost-effective strategy for firms looking to reduce insurance costs while maintaining comprehensive coverage.

Implementing Safety Measures

Implementing safety measures, such as providing employee training, maintaining proper documentation, and investing in security systems, can help reduce the likelihood of accidents or claims. By demonstrating a commitment to safety, small consulting firms can potentially qualify for lower insurance premiums due to reduced risk exposure.

Negotiating with Insurance Providers

When seeking insurance coverage, small consulting firms should not hesitate to negotiate with insurance providers to secure affordable rates. By comparing quotes from multiple providers, highlighting the firm's risk management practices and safety measures, and discussing the possibility of adjusting coverage limits or deductibles, firms can potentially lower their insurance costs without compromising on coverage.

Case studies of successful insurance solutions for small consulting firms

Insurance plays a crucial role in protecting small consulting firms from potential financial risks. Let's explore a case study of a small consulting firm that effectively managed insurance costs and implemented successful insurance strategies.

Case Study: XYZ Consulting Firm

XYZ Consulting Firm, a small consulting business specializing in marketing solutions, faced challenges in managing insurance costs while ensuring comprehensive coverage for their operations.

- Implemented a tailored insurance plan: XYZ Consulting Firm worked with an insurance broker to customize an insurance plan that addressed their specific needs, including general liability, professional liability, and cyber insurance.

- Regular risk assessments: The firm conducted regular risk assessments to identify potential areas of vulnerability and adjust their insurance coverage accordingly.

- Employee training: XYZ Consulting Firm invested in employee training programs to mitigate risks and reduce the frequency of insurance claims.

Outcomes of Comprehensive Insurance Coverage

By investing in comprehensive insurance coverage, XYZ Consulting Firm experienced:

- Financial protection: The firm was able to cover unexpected costs related to client disputes, data breaches, and other liabilities without significant financial strain.

- Enhanced reputation: Having robust insurance coverage helped XYZ Consulting Firm build trust with clients and demonstrate their commitment to professionalism and risk management.

Handling Insurance Claims

XYZ Consulting Firm faced a situation where a client alleged negligence in a marketing campaign that resulted in financial losses. The firm's insurance coverage for professional liability kicked in, covering legal fees and settlement costs, ultimately safeguarding the firm's financial stability.

Conclusion

In conclusion, Affordable Insurance for Small Consulting Firms is a vital component in safeguarding the interests of consulting businesses. By understanding the key factors, coverage types, and cost reduction strategies discussed, small consulting firms can navigate the insurance landscape with confidence and financial prudence.

Key Questions Answered

What factors can influence insurance costs for small consulting firms?

Factors such as the size of the consulting firm, the type of services offered, risk factors, and location can all impact insurance costs.

Why is professional liability insurance important for consulting businesses?

Professional liability insurance protects consulting firms against claims of negligence or errors in their professional services.

How can risk management practices help lower insurance premiums?

Implementing effective risk management practices can demonstrate to insurers that the consulting firm is proactive in minimizing risks, potentially leading to lower premiums.

Can negotiating with insurance providers help secure affordable rates?

Yes, negotiating with insurance providers and exploring different coverage options can help small consulting firms find more affordable insurance rates.