Exploring the relevance of Whole Life Insurance in 2025 opens up a realm of historical insights, current perspectives, and futuristic possibilities. Dive into this discussion with a blend of knowledge and curiosity.

Delve into the evolution of whole life insurance, its traditional role, and the key factors shaping its relevance over time.

Historical Perspective of Whole Life Insurance

Whole life insurance has a long history dating back to the 18th century when it was first introduced as a way to provide financial security to families in case of the breadwinner's death. Over the years, whole life insurance has evolved to adapt to changing financial landscapes and customer needs.

Evolution of Whole Life Insurance

Initially, whole life insurance policies were simple and focused on providing a death benefit to beneficiaries. However, as the financial industry grew more complex, insurance companies began offering additional features such as cash value accumulation and the ability to take out loans against the policy.

Traditional Role and Purpose of Whole Life Insurance

- Provide a guaranteed death benefit to beneficiaries.

- Build cash value over time that can be accessed by the policyholder.

- Offer a stable and long-term financial planning tool.

Key Factors Influencing Relevance of Whole Life Insurance

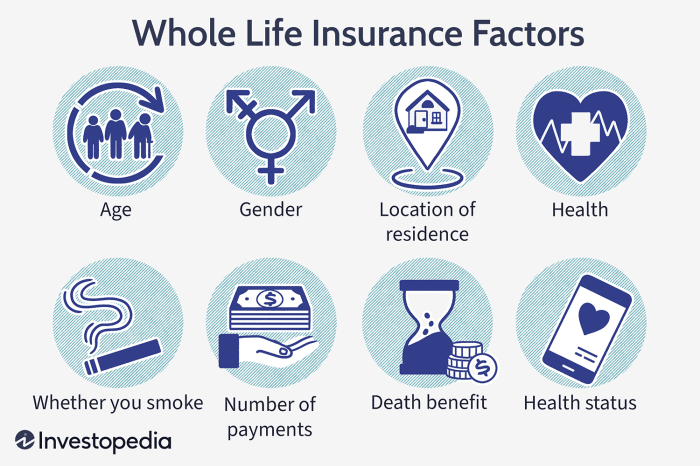

- Interest rates: Fluctuations in interest rates can impact the growth of cash value within a whole life insurance policy.

- Market conditions: Economic downturns or upswings can influence the performance of the investments held within the policy.

- Consumer preferences: Changing customer needs and preferences for financial products can shape the demand for whole life insurance.

Current Landscape of Whole Life Insurance

Whole life insurance policies continue to be relevant in the insurance market due to their unique features and benefits.

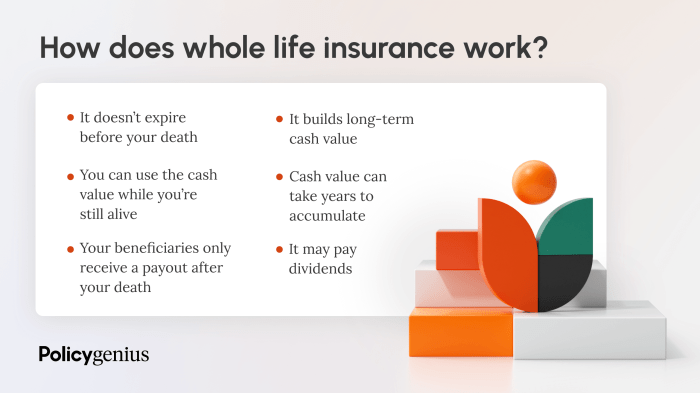

Features and Benefits of Whole Life Insurance

- Guaranteed death benefit: Whole life insurance provides a guaranteed payout to beneficiaries upon the policyholder's death.

- Cash value accumulation: These policies build cash value over time, which can be borrowed against or withdrawn.

- Fixed premiums: Premiums for whole life insurance remain constant throughout the life of the policy, providing predictability for policyholders.

- Estate planning tool: Whole life insurance can be used as a tool for estate planning, providing tax benefits and ensuring financial security for loved ones.

Comparison with Other Types of Life Insurance

- Term life insurance: Unlike term life insurance, which provides coverage for a specific term, whole life insurance offers coverage for the entire life of the insured.

- Universal life insurance: Whole life insurance differs from universal life insurance in that it offers more guarantees and stable premiums.

- Variable life insurance: While variable life insurance allows for investment in the stock market, whole life insurance focuses on cash value accumulation with guaranteed returns.

Demographic Trends Impacting Demand for Whole Life Insurance

- An aging population: As the population ages, there is an increased need for financial security and estate planning, driving the demand for whole life insurance.

- Interest in long-term financial planning: With a growing focus on long-term financial stability, more individuals are turning to whole life insurance as a way to secure their financial future.

- Desire for guaranteed returns: In uncertain economic times, the guaranteed cash value growth and death benefit of whole life insurance are appealing to individuals looking for financial security.

Technological Advancements in the Insurance Industry

In today's rapidly evolving digital landscape, technological advancements have significantly impacted the insurance industry, including the whole life insurance sector. The integration of Artificial Intelligence (AI), data analytics, and digital platforms has revolutionized the way insurance companies offer and manage whole life insurance policies.

Utilization of AI in Whole Life Insurance

AI plays a crucial role in enhancing customer experience and streamlining processes in the whole life insurance sector. Insurers utilize AI-powered chatbots to provide instant customer support, personalized recommendations, and quick policy approvals. This not only improves customer satisfaction but also increases operational efficiency for insurance companies.

Data Analytics for Personalized Policies

Data analytics tools enable insurers to analyze vast amounts of customer data to tailor whole life insurance policies according to individual needs and preferences. By leveraging predictive analytics, insurers can accurately assess risk factors, determine appropriate coverage levels, and offer competitive premium rates to policyholders.

Digital Platforms for Seamless Policy Management

The rise of digital platforms has transformed the way customers interact with insurance providers for whole life insurance. Policyholders can now access their policy information, make premium payments, and file claims conveniently through online portals and mobile apps. This shift towards digitalization has enhanced accessibility, transparency, and overall customer satisfaction in the insurance industry.

Impact of InsurTech on Distribution Channels

InsurTech startups are disrupting traditional distribution channels in the insurance sector by offering innovative solutions for marketing, selling, and managing whole life insurance policies. These tech-driven platforms utilize advanced algorithms and automation to target specific customer segments, optimize underwriting processes, and deliver personalized policy recommendations in real-time.

Economic and Regulatory Factors Influencing Whole Life Insurance

When considering the relevance of whole life insurance in 2025, it is crucial to examine the various economic and regulatory factors that can significantly impact the performance and attractiveness of these insurance products.

Impact of Economic Conditions

- The performance of whole life insurance is heavily influenced by economic conditions such as interest rates and inflation. When interest rates are low, the cash value growth of the policy may be affected, making it less attractive as an investment vehicle.

- Inflation can also erode the purchasing power of the policy's death benefit over time, potentially reducing its value for beneficiaries.

- It is essential for policyholders to consider these economic factors when evaluating the long-term benefits of whole life insurance.

Regulatory Environment and Product Design

- The regulatory environment plays a crucial role in shaping the design and marketing of whole life insurance products. Regulations set by governing bodies can impact the features, pricing, and availability of these policies in the market.

- Compliance with regulatory requirements is essential for insurance companies to ensure the transparency and fairness of their offerings to consumers.

- Changes in regulations can also influence the competitiveness and innovation within the whole life insurance sector.

Impact of Tax Laws

- Changes in tax laws can have a significant effect on the attractiveness of whole life insurance as an investment vehicle. Tax advantages, such as tax-deferred growth and tax-free death benefits, are key selling points for these policies.

- Potential alterations in tax laws may impact the tax treatment of policy withdrawals, loans, and overall estate planning strategies involving whole life insurance.

- Policyholders and financial advisors must stay informed about any changes in tax legislation that could affect the overall benefits and returns associated with whole life insurance.

Epilogue

As we conclude our exploration of the relevance of Whole Life Insurance in 2025, we reflect on the past, present, and potential future of this financial tool. The discussion leaves us pondering the enduring value of whole life insurance in an ever-changing world.

Q&A

Is whole life insurance a good investment in 2025?

Whole life insurance can still be a valuable investment in 2025, providing both financial protection and a savings component.

How does whole life insurance differ from term life insurance?

Whole life insurance offers coverage for the entire life of the insured, while term life insurance provides coverage for a specific term.

Can I customize my whole life insurance policy to suit my needs?

Yes, many insurance providers offer customization options to tailor your whole life insurance policy to your specific requirements.

![12 Best Ecommerce Business Insurance Options For Online Retailers [2025]](https://startup.jatimnetwork.com/wp-content/uploads/2025/07/www.nationwide.com_business_insurance_Screenshot-768x461-1-75x75.png)